As the biggest producer and consumer of

titanium products, the US, with its three magnates of Timet, RTI, and ATI, took

up the monopoly position in the market and thus has had significant impact on

the development of the titanium industry.

The three enterprises, who are more

concerned with the quality rather than the quantity of the patents, are active

in promoting the layout of patents. In terms of the emphasis of the layout, the

enterprises paid more attention to the layout of core and fundamental patents,

and the techniques were mostly concentrating on the midstream of the industrial

chain. In terms of the phase of development, the layout has still been in the

phase of combination and construction, and therefore there’s a very obvious

intention to complete and supplement the patent portfolio through commercial

acquisition. In terms of the strategy of layout, the areas of patent layout

were highly consistent with the target market.

Due to the highly complex techniques for

the titanium melting, there are only four countries--the US, Russia, Japan, and

China--mater the integrated techniques for processing titanium, among which the

US was the pioneer of the industry.

The titanium alloy industry shows an

obvious characteristic of oligopoly and dependency. The production of the major

three of the industry - TIMET (has already been purchased by PCC with no marked

changes in its business direction), RTI, and ATI - have accounted for about 90%

of the total output in the US, and thus it is these companies that determined

the technological level and development direction of the titanium alloy

industry in the US.

As time went on, these three companies have

still been on their way to increase the market share. With the oligopoly and

dependency turned more and more intensified, the magnates of the titanium alloy

have an obviously stronger influence to the industry than that of other

industries.

Profiles of Three Magnates of Titanium

Alloy Industry in the US

1. Timet

Established in 1990, Timet has been one of

the dominant producers of the titanium products with its headquarters located

in Dallas, the US. At the same time, Timet has also been the biggest producer

of the titanium sponge and the recycler of the titanium defective materials in

the US with the principal products of titanium sponge, casting products, rolled

products and finished products. As civil aviation department is the major

customer for Timet, the company formulated its long-term development strategy

as maximizing its value in the core airline business and, at the same time,

expanding the utilization in non-aviation market and developing new products.

2. RTI International Metals

With the headquarters located in Niles,

Ohio, RTI is an old-brand and professional producer of aeronautic titanium

products and high-end titanium manufactured products with glorious history of

more than 50 years. The company, whose predecessor was RMI (the top two

titanium manufacturer in the US), devoted itself to the producing and selling

of aircraft-grade titanium alloy slab and has been the major supplier for

Boeing, Airbus, and BAE systems.

3. ATI (Array Technology Industry)

ATI, with the headquarters located in

Pittsburgh, Pennsylvania, is the biggest producer of special steel across the

world and the third producer of titanium products in the US. ATI is a regular

supplier for the titanium products of aviation and biomedical fields. The major

products of the company can be categorized into: flat rolled products,

high-performance metals, and engineering products.

Analysis

on Patent Layout of Timet

1.Profile of Timet’s Patent Layout

Timet started very early in applying global

patents. The company focused more on the quality rather than the quantity of

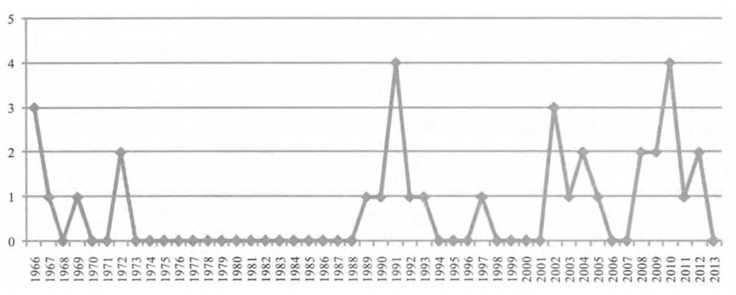

the patent. Timet began to apply the patent relative to the titanium ally since

1966, as shown in the Fig.1, however, the companies had not deliberately

applied the patents to protect its scientific results before 2000, so we can

see there’s a vacancy in Fig.1.

Fig. 1 Application Profile of Timet’s

Global Patents over the Years

Source: Espacenet Patent Search of European

Patent Office (EPO)

Timet has laid more emphasis on the patents

application since 2000. However, generally, the patents of Timet was not

characterized by the high quantity, since there were only 35 patents Timet

applied in global titanium alloy industry up to September 2014, with the

highest annually application of 5.

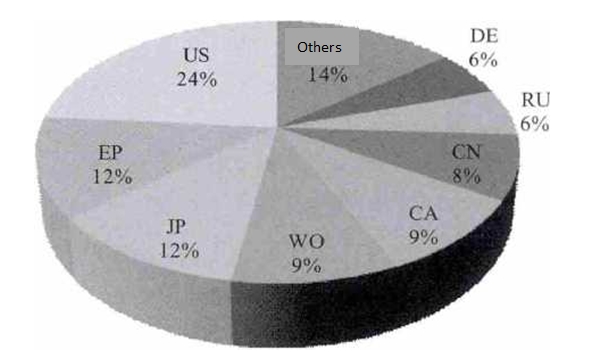

The more revenue the company gained from an

area, the larger share of patents layout it would allocate in that area. For

example, there were 24% of the patents in the US and 9% of the patents in

Canada, and thus 60% of company’s revenues came from North American market.

AS European market took up 31% of company’s

revenue, it has been the second target for the patent layout, among which Timet

submitted 12% of the patents application to European Patent Office and 6% in

Germany. Besides, Timet also quite valued its third market of Japan, in which

the company submitted 12% of the patents application.

Although the proportion of the revenue from

China’s market was not very high, Timet allocated 8% of patents in China, prior

to Russia and Germany. That’s to say, with the development of China’s civil

airline business and opening up, China has been a very promising market for

Timet and the company has already prepared itself in the level of patents to

enter China’s market.

Fig.2 Geographical Distribution of Timet’s

Global Patents Application

Timet has very comprehensive categories in

patents with the layout in upstream, midstream, and downstream of the industry

chain, while the focus of the layout laid on the midstream areas involving the

processing techniques of the titanium alloy. In terms of the patents of Timet

applied in China since 2003, all remains valid but one doesn’t.

Up to September 2014, there were 8 valid

patents for Timet in China. In terms of technology structure, only one patent

was for the manufacturing method of titanium alloy, the other seven were all

for the research of new titanium alloy. In terms of the technology

characteristics, Timet’s patents mainly emphasized on the processing techniques

involved four aspects -- anti-corrosion, high strength, thermostability, and

low cost.

1. Strategy of Timet’s Patent Layout and

Its Characteristics

(1) With

the characteristics of multicore, low aggressivity, and low costs on the

application and maintenance, the patents layout of the Roadblock Pattern was

adopted by Timet. The patents concerned the characteristics of titanium alloy,

each of which was not very closely linked with the others.

From 1960s to 2010, Timet has always kept

the above-mentioned layout in terms of patent application. With the help of

company’s comprehensive and accurate grasp on the globally advanced technology

and the correct cognition to the innovative ability of its competitors, the

layout of Roadblock was good at fighting against the competitors in the

titanium alloy products.

However, there’s still a space for

competitors avoiding and finally breaking through the roadblocks by the means

of Design Around. More importantly, it would give competitors inspiration in

their research and thus reduce the R&D costs.

(2) The

recent tendency of patent layout can be summarized as two aspects:

strengthening the patents layout on the low-cost characteristics and weakening

the layout on the processing techniques. Timet started its development on the

low-cost titanium alloy from 1993, which was relatively late compared with

others, and the company then applied three low-cost patents in 2011, 2012, and

2013 respectively.

Contrarily, most of the patents concerned

processing techniques were applied in early stage of Timet, for example, the

US2985747 was applied in 1961, US3239440 was in 1966, all of which are invalid

as there’s only 20 years of the term of patent protection. The nearest

application was in 2005 from its purchased company Axel Johnson.

In the recent years, Timet intended to

improve the producing and processing ability by the means of internal

extension, long-term third party agreement, and potential joint-venturing and

purchasing so as to meet the requirements of the promising titanium market.

After gradually purchasing most of European titanium enterprises, including IMI

of the UK, CEZUX of France, TIMET of Germany, and VALINOX of France, the Timet

itself was purchased by a downstream enterprise – PCC -- in the US at the end

of 2012 and transferred to be an important department of the first phase of

industry chain of aviation.

*This article is edited and translated by

CCM. The original version comes from China Invention & Patent.

About

CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content

solutions, from price and trade data to industry newsletters and customized

market research reports. Our clients include Monsanto, DuPont, Shell, Bayer,

and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in

touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.